Once you select us to obtain your home loan, you’ll be amazed at how quickly and simply the loan process moves. Before you know it, you’ll have a mortgage that suits your lifestyle and saves you money.

Throughout the loan-application process, we provide you with regular updates. You can also e-mail us with questions or new information. And if you want assistance, a mortgage expert who can answer questions is just a phone call away.

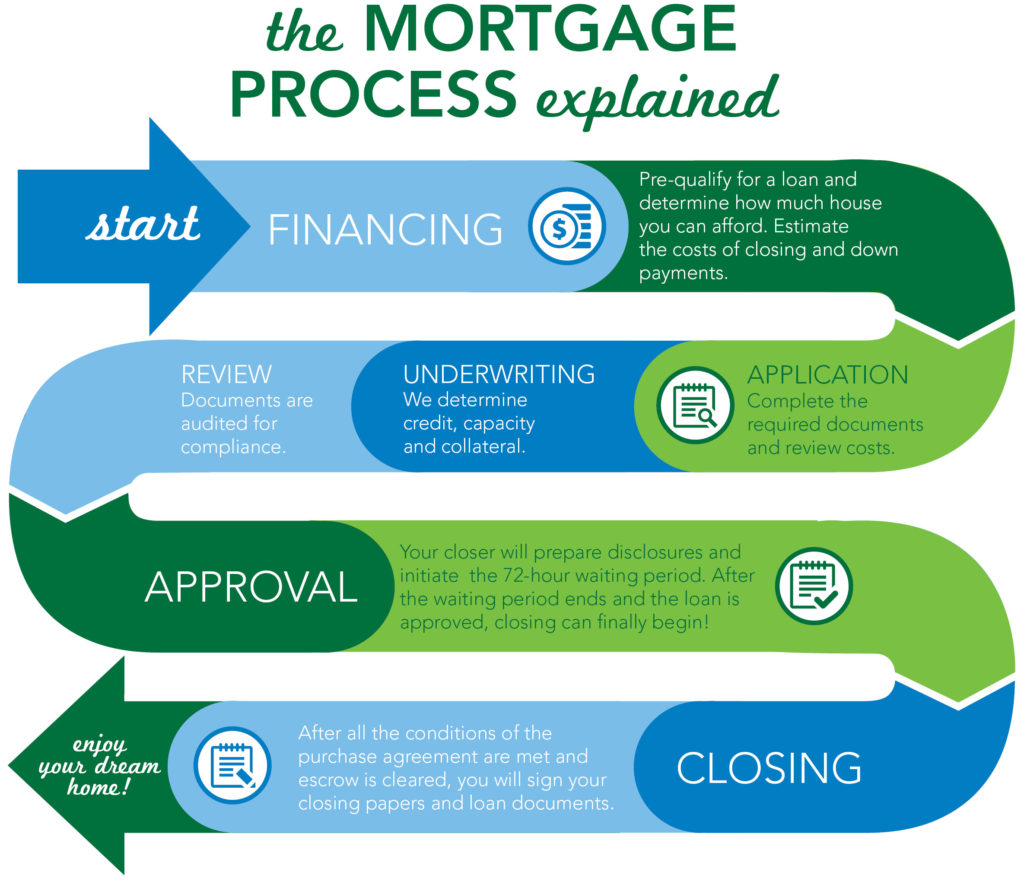

Here’s an overview of the loan-application process

STEP ONE — Apply Now! Getting started is easy

Before house hunting, you should get pre-approved so that you know how much house you can afford. If you are refinancing, there is no need to get pre-approved; simply turn in the documents from the checklist.

At the appropriate time we’ll order a property appraisal for you.

STEP TWO —

Once you are under contract or ready to start your refinance, we will submit your documentation to the bank. This initial submission usually takes around five business days. At this time, the bank reviews audits your file for compliance and issues a conditional approval or denial.

If your loan is approved with conditions, you must supply the other required documentation and resubmit the file for audit. This process usually takes 1-2 business days. One all your conditions are cleared, you are issued a clear to close and your closing disclosure is sent out. From this point, you must wait 3 days to comply with TRID. Once the 3 day waiting period is over, you are ready to close.

STEP THREE — Your Loan is Approved and Funded

If you are purchasing, your Real Estate Agent or the Seller will designate an Escrow/Title Company to handle the funding of your loan, along with many other factors which make your purchase go smoothly.

We will coordinate with the escrow team and you’ll sign the final papers at their office.

Simple, Straightforward, Cost Effective, and FAST!